Tuesday, March 23, 2010

Independence and Exclusivity

Sunday, March 21, 2010

A country within a country

We are a country of a billion people and more.

As I make my return journey to Delhi (with my heart, I believe that it is my adopted home, I always return to it), I start to remember how easy it was to get a train ticket in France. Not only did you have the liberty of buying it on the spot, but in case you postponed your journey, you could use the same ticket to make a journey later. All thanks to a low population compared to ours. Will we ever get to that stage? I don’t think so. We will never be able to decrease our population or increase the size of our country. Hence I will never enjoy that luxury.

This makes me think about our population and its rate of growth. I think the growth is unequally divided. Men and women of my generation don’t think of having more than two kids. The urban centers and the educated are getting wiser and seem to know better now. The bulk of the growth rate can be attributed to, in my opinion, the uneducated and the poor. This is a premise. But suppose this premise is true, there are some things that come to my mind. First, if we can concentrate on the urban middle class of our generation, we might see a country within a country. This concept is not novel. When we talk of India shining, this is the country than we refer to. This country has a high average income and excludes the poor and the uneducated from the villages and the cities (slum dwellers). The population of this country will stabilize. As people get more and more ‘western’, living together and not having any kids might even become a possibility and the population might even decrease (oh I wish!). Though the overall population of the country will increase, the other half will be sidelined and become invisible as they seem to be currently are. Second, the competition that we went through for a career and jobs, and our worries for the impossible condition of our children might come to pass. This is again based on an opinion that people from one half of the poor and uneducated country, whose population is the one that is increasing, will rarely transit and become competition for the other half – the educated and the privileged. They will compete amongst themselves for land, labor-jobs, auto-driver and security guard positions. They will not know of the McKinseys, the Goldman Sachs and the Sequoias…

Monday, March 15, 2010

The second world war

Sunday, March 14, 2010

Another theory on obesity and heart disease

I read something pretty amazing on the Economist's science section recently. A new theory by two scientists in the University of Texas challenge the entire interpretation of obesity and its linkage with heart disease, diabetes and liver failure.

Tentative steps

I am not an old blogger. I started primarily because writing is a skill that needs to be honed. But now that I do write publicly once in a while, I am trying to branch out as much as I can ...

Monday, March 8, 2010

Public Debt

The Indian budget was unveiled recently. Amongst other things, it talks about reducing the budget deficit from 6.9 percent of the GDP to 5.5 percent of the GDP.

The Indian budget was unveiled recently. Amongst other things, it talks about reducing the budget deficit from 6.9 percent of the GDP to 5.5 percent of the GDP. Friday, March 5, 2010

One-tenth of the real money

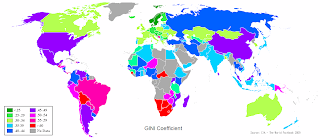

The Gini coefficient

The Gini coefficient is an interesting number. It ranges from 0 to 1 and shows how equitably the GDP of a nation is distributed amongst its citizens. 0 is the most equitable and 1 is the least. The index is not very clear but some examples are : Purple is around 0.5, Cyan is 0.35, Red is greater than 0.6, light green is 0.35 and pink is about 0.55

The Gini coefficient is an interesting number. It ranges from 0 to 1 and shows how equitably the GDP of a nation is distributed amongst its citizens. 0 is the most equitable and 1 is the least. The index is not very clear but some examples are : Purple is around 0.5, Cyan is 0.35, Red is greater than 0.6, light green is 0.35 and pink is about 0.55